Our European Focus List offers top-quality European stocks that best fit our proven O’Neil Methodology (OM). Our analysts, who specialize by region and country, uncover bullish and bearish European ideas and identify sectors and countries that are rotating into and out of favor with changing market conditions.

Our dedicated team of Europe analysts is highly experienced, with nearly two decades of experience covering European markets.

Using our proprietary equity research platform PANARAY®, our analysts screen a broad universe of companies with our proprietary Ratings and Rankings, so we don’t miss much.

“Our technical approach allows our analysts to recommend stocks in a timely manner, and our proven sell discipline helps you avoid significant losses.”

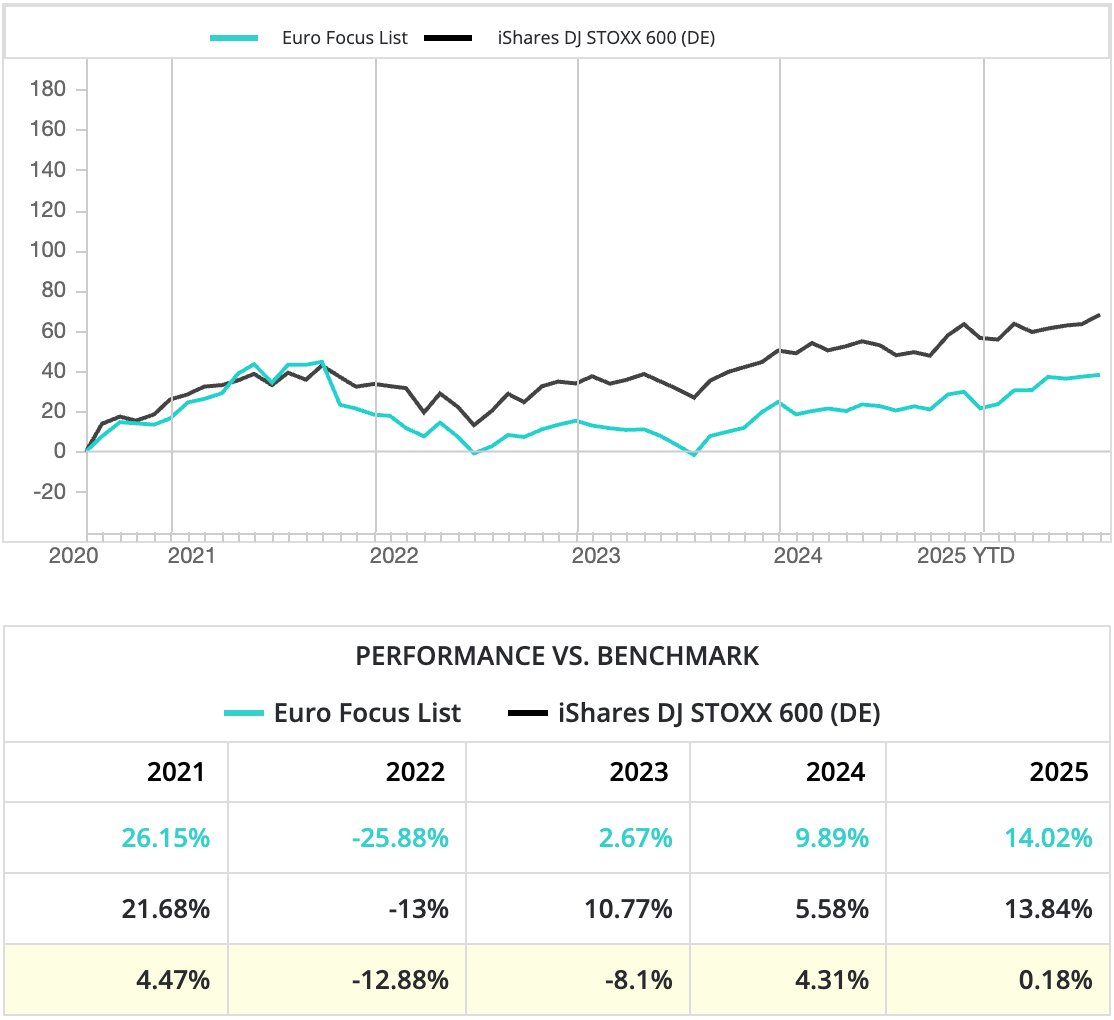

Performance results do not represent actual trading and may not reflect the impact that material, economic, and market factors might have had on the investment-making process if actually managing client money. There is substantial speculative risk in most international stocks. Past performance is not necessarily an indication of future performance. Performance computations for the European Focus List reflect a time-weighted rate of return. All holdings are rebalanced to equal dollar amounts daily. Dividends are not considered in computations. Percent gains and losses are calculated for all issues that remain on the “Buy Recommendations” at the end of the day.

For issues that were added to “Buy Recommendations,” the basis used to calculate the percent change is the price noted when the issue appeared as a “Buy Recommendation” in the European Focus List Alerts. For issues that were removed, the selling price used to calculate the percent is the price noted when the issue appeared as “Removed” in the European Focus List Alerts.